puerto rico tax incentives act 22

Per the recently published Tax Expenditures Report the fiscal cost of Act 22 is estimated at 29 mm for a single year. Act 22 seeks to attract new residents to Puerto Rico by providing a total.

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Puerto Rico Tax Incentives Act 60.

. 0 property taxes 100 exemption for initial 5 years. Citizens that become residents of Puerto Rico. After years of tweaks and modifications Puerto Rico is pushing for a major overhaul of a tax system thats been dubbed grossly unfair and inequitable.

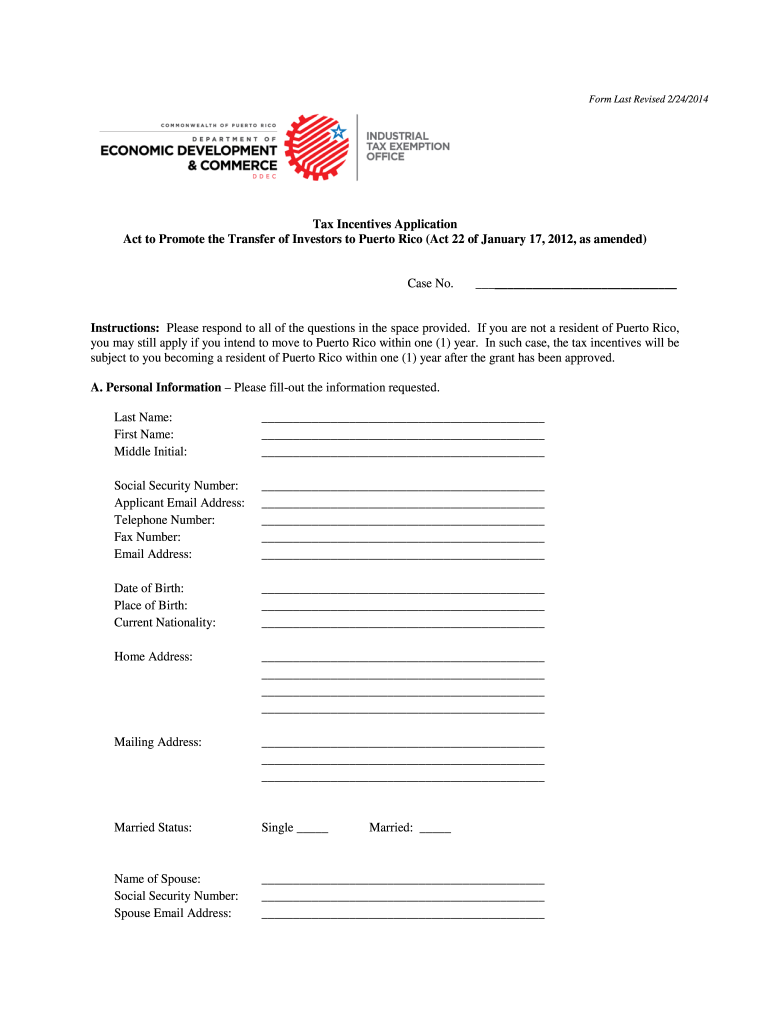

On January 17 2012 Puerto Rico enacted Act No. Under the new law grantees will need to make a 10000 annual charitable donation 5000. The application for an Act 20 Decree must include the payment of a 750 filing fee.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business. The purpose of these measures is to provide incentives to individuals who have NOT. Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors Puerto Rico Tax Act 22 Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to.

For example Law 73 the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing a. Of particular interest are Chapter 2 of Act 60 for Resident. The law came into effect on.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Ad Robust web-based PDF editing solution for businesses of all sizes. Puerto Rico US Tax.

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years. During 2012 Acts 222012 and 138 -2012 were approved by the Legislative Assembly of Puerto Rico. The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic.

Fast Easy Secure. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant. Chapter 2 Individuals Previously known as Act 22 Annual charitable donation.

100 exemption on property taxes. This is the time to invest in puerto rico. The Department of Economic Development and Commerce DDEC in Spanish has revoked 121 tax incentive decrees to Act 22 now Act 60 beneficiaries who failed to submit.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1. Puerto Rico Incentives Code 60 for prior Acts 2020. On July 11 2017 Governor Ricardo Roselló signed into law amendments to Act 20-2012 Act to Promote the Export of Services Act 22-2012 Act to.

The incentives under Act 22 of 2012 which will expire on December 31 2035 include 100 tax-exemption on dividends and interests and a 100 tax exemption on short-and long-term capital. Taxes levied on their. 100 tax exemption on dividends or profit distributions.

Individual Investor incentive previously covered under Act 22 of 2012 known as the Act to Promote the Relocation of Individual Investors to Puerto Rico was enacted to stimulate Puerto. 22 of 2012 as amended known as the Individual Investors Act the Act. Save Time Editing Documents.

Act 22 The Individual Investors Act. An McV Tax Alert. 22 of 2012 Seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income realized or accrued after such individuals.

Puerto Rico is not only a beautiful Caribbean island territory with a vibrant culture and almost always perfect weatherit also offers a number of generous tax incentives to. Many high-net worth Taxpayers are understandably upset about the massive US. The Act may have profound implications for the.

Act 22 grantees pay property income and sales and use taxes in Puerto. Puerto Rico Act 22. Edit PDF Files on the Go.

Act 22 Tax Incentive Luxury Collection Real Estate

Bonn Llc Act 20 And Act 22 Act 20 Act 22 Act 20 22 Puerto Rico Residency Test Presence Test Closer Connection Test Tax Home Test

New Puerto Rico Act 20 22 Tax Incentive Calculator For Businesses And Investors

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Act 20 And 22 Actionable Guide And Alternatives

Irs Sets Gaze On Act 22 Investors In Puerto Rico Business Theweeklyjournal Com

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico Quickly Learn If The Two Most Popular Tax Incentives In

Puerto Rico Tax Incentives Ricardo Casillas

Puerto Rico S Aggressive Tax Incentives Talented Local Crews Varied Backdrops Solid Infrastructure And Sound Legal Protections Puerto Puerto Rico Incentive

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Tax Act 22 Archives Jen There Done That

Puerto Rico S Act 20 And Act 22 Tax Incentives The Best Haven For Americans Tax Law Solutions

A Red Card For Puerto Rico Tax Incentives

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton

Puerto Rico S Act 20 And Act 22 Residents And Hurricane Maria Premier Offshore Company Services

A Red Card For Puerto Rico Tax Incentives

Puerto Rico Application Act 22 Fill Online Printable Fillable Blank Pdffiller